Is Snapchat A Good Buy

- Home

- The Meme Stock Maven

- Other Memes

Publish date:

Buy Snap Stock On The Dip, Say Wall Street Experts

Not usually considered a meme stock, Snap behaved like one recently. Yet, despite dropping 27% in the past five days, Wall Street is still as bullish as ever on the social media shares.

Snap stock's (SNAP) - Get Snap, Inc. Class A Report popularity has recently peaked on Reddit's main forums. The reason for it was that the stock's biggest one-day share price decline of 27% that followed the company's ill-received third quarter earnings report.

Figure 1: SNAP stock popularity on WSB.

Swaggy Stocks

Issues with Apple's iOS policies regarding activity tracking led to Snap's disappointing results and outlook, which ended up pushing SNAP shares lower. Still, Wall Street consensus suggests that bearish momentum does not change the fundamentals, and that investors should buy the dip.

Biggest one-day drop on record

Snap Inc. posted its biggest one-day drop on record – even though Snap's Q3 results were not disastrous, at first glance. According to our sister channel Apple Maven:

"The revenue miss of $30 million (representing four percentage points' worth of top-line growth) was noticeable, but arguably not enough to make nearly one-third of the market value of Snap's equity vanish in a snap of the fingers (pun intended).

The problem is that the revenue disappointment brought to light a sore subject in the internet and social media sectors. Earlier this year, Apple updated its iOS policies, giving device users the ability to opt out of activity tracking by third-party apps. The move was widely expected to hurt those whose business models rely on serving targeted ads – i.e. most social media and other internet companies."

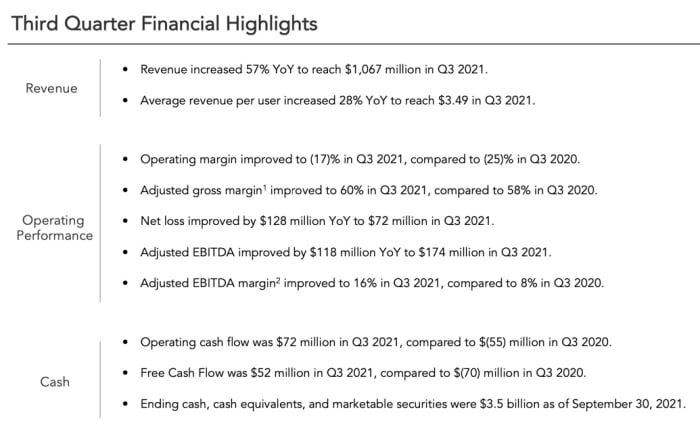

Figure 2: SNAP's Q3 financial highlights.

Snap Investor Relations

Wall Street is as bullish as ever

Experts' consensus rating on SNAP is a buy. Based on the opinions of 27 Wall Street analysts published in the last 3 months, the upside potential ahead is sizable. The average price target is $76.48, which represents potential gains of 40% from the last price of $54.50.

- The most bullish is Credit Suisse analyst Stephen Ju. Even though he recently lowered the firm's price target on Snap to $104 from $111, he still sees a 90% climb ahead. Mr. Ju does not believe that the company's value has changed after earnings. According to the analyst, Q3 was impacted by measurement headwinds and supply chain issues that are transitory.

- Another bull, Piper Sandler's Thomas Champion has set a price target of $75 and reiterated an overweight rating on the shares. He echoes that key factors driving the disappointing results were Apple App Tracking Transparency changes and macroeconomic factors. However, the analyst believe that Apple's issues are an "industry-wide, temporary phenomenon" and still likes Snap's user growth momentum and long-term opportunities.

- Bank of America analyst Justin Post has a neutral rating on SNAP. He recently lowered the firm's price target to $67 from $80 following quarterly results. His skepticism is grounded on measurement and supply chain pressures on Q4 direct response ad spend, which he sees as a negative for the entire online media space.

- Citi analyst Jason Bazinet is the lone bear, with a sell rating and a $67 price target on SNAP —oddly still representing 22% upside potential. His bearishness was reinforced after the company reported Q3 revenue below consensus and just below the lower end of the guided range. More importantly, 4Q guidance landed well below Wall Street's projections, as the company blamed "macro uncertainty driven by supply chain disruption and labor shortages."

Twitter speaks

SNAP recently logged its largest single-day share price drop after the company disappointed on earnings day – but Wall Street analysts remain bullish on the stock. Where do you see SNAP stock going?

Get more expert analysis on "stonks"

It's never too early (or late) to start growing your investment portfolio. Join the Real Money community for just $7.50/month and unlock expert advice from our team of 30+ investing pros.

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting Wall Street Memes)

Is Snapchat A Good Buy

Source: https://www.thestreet.com/memestocks/other-memes/buy-snap-stock-on-the-dip-say-wall-street-experts#:~:text=Experts'%20consensus%20rating%20on%20SNAP,the%20last%20price%20of%20%2454.50.

Posted by: underwoodcolowerve.blogspot.com

0 Response to "Is Snapchat A Good Buy"

Post a Comment